A shallow dive into the relationship between Macroeconomics and Crypto Winter:

It is no longer news that the crypto and web3 economy is undergoing a bear market so severe that no-coiners can tell. Bitcoin fell from an all-time high of $68,000 per unit to less than half of the ATH, with recent prices ranging between $18,000 - $20,000. Likewise, Ethereum and other altcoins were not left out as crypto’s market capitalization fell below a trillion dollars from highs above 2 trillion dollars. The crash in crypto tokens also impacted NFTs. There was a drastic decline in the floor price of some of the most popular and valuable NFTs, such as Bored Apes, Meebits, and Moonbirds. Beyond tradable digital assets, social media platforms like Twitter, where web3 participants form a community or communities, have also faced a continuous reduction in the number of individuals actively engaging these communities due to the market downtrend.

Long story short, “it’s a darn bear market, baby.”

A bear market in crypto, according to Blockworks, is a period of prolonged and often volatile decline in the price of nearly all assets. Although the bear market mainly revolves around tokenomics and asset market activity, a noticeable feature of the recent crypto winter is widespread layoffs in multiple crypto/web3 companies and sporadic declarations of insolvency by a few others. Coinbase laid off over 1,000 employees and Opensea, while web3 companies such as Voyager and Celsius filed for bankruptcy, all in 2022. It is cold in the winter; in this (crypto) winter, it gets colder, given that the return of a favorable or bull market (the opposite of a bear market) is based on pure speculation. However, there is a consistent phenomenon considering how the general state of world economics directly influences the crypto markets. The question is, how?

If you’re a newbie to the financial markets, you are most likely hearing about “Macroeconomics” for the first time, or you’ve probably heard of it, but you’ve not paid as much attention as required to grasp what it is entirely. Let’s take a brief walk into the world of Macroeconomics and how it relates to the current crypto winter.

Macroeconomics and Crypto

The world comprises countries with economic activities defined by their internal regulations and inter-state economic policies. Macroeconomics is the sum of economic activities within each country. It looks to analyze the bigger economic picture from various economic indicators, activities, and factors.

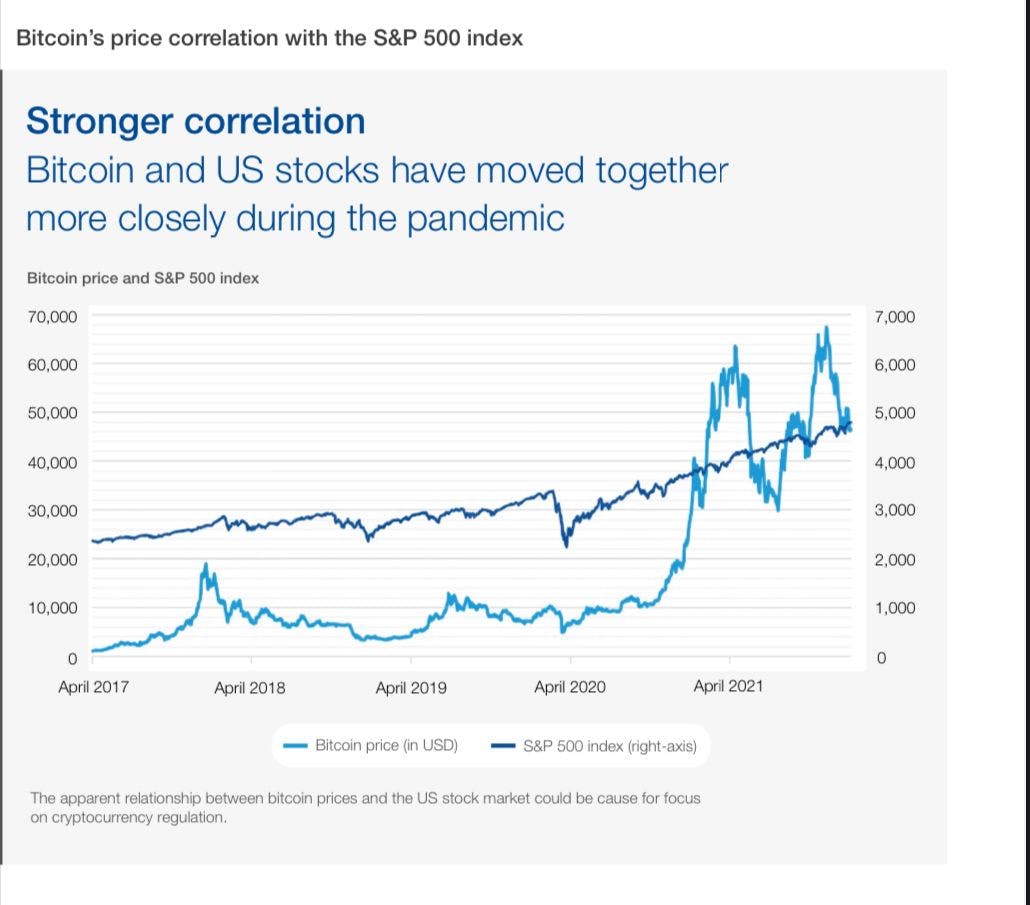

The economic times define Macroeconomics as the behavior and performance of an economy. On a larger scale, world macroeconomics or global macroeconomics is the general behavior and performance of the world’s economy due to policies and activities of strong or impactful economies. Some indices associated with Macroeconomics are inflation rates, GDP, unemployment metrics, and the Consumer price index, among others. Recently, bitcoin’s reaction to movements in the traditional markets points toward the overall effect that Macroeconomic forces have on cryptos. In mid-2021, bitcoin price charts followed similar patterns to that of the S&P 500 charts.

See the illustration below:

The image above was taken from weforum.

The image above was taken from weforum.

In 2022, the global economy has encountered specific challenges and events that have conditioned the economic markets. Some of these events are:

- The Russia-Ukraine war and rising oil prices across the US and Europe

- Increasing inflation rates in the US and the UK

- Red alert on Credit Suisse and Deutsche bank instability: A thread on Credit Suisse and Deutsche bank saga.

Although the cause of the 2022 crypto winter is said to be an assortment of factors, it remains true that the relationship between the cryptocurrency markets and macroeconomics has grown slightly stronger. From a positive angle, the influence of macroeconomics on crypto might help predict the beginning of a bull run, i.e., in the advent of a u-turn in general macroeconomics. It’ll be of great use to anyone to keep eyes peeled for traditional financial events