While I may not be as technically and creatively competent as Cobie to hold the chalice of bourgeois-filled words or understanding of the industry required to craft such an insightful piece on the behavioral aspect of the crypto-verse, I intend to create a simple sequel for those who may or may not be lost or would prefer a simpler way to digest such rich content as opposed to the Cobie structure. So, let's break down the molecules, take a bite, and digest it all to understand what the metagame is, and also cross-examine the possibility that reward tokens may be the metagame at work in the crypto-verse right now.

## What is the Metagame?

The article breaks it down into two (2) - The Meta and the Metagame. Cobie conceptualizes the meta as a gaming phenomenon. He draws his insight from the psychology of a gamer and the game itself, wherein the game developer intends to create an ever-increasing high level of complexity or “difficulty” to sustain the enthusiasm of the player. Picture it as playing an arcade game and going on missions. With each completed mission, the player gets a bit better at understanding the technicalities of the game such as knowing which characters are best efficient for certain stages of the game (Weaker and stronger characters). As the player acquires more understanding of the game and formulates, learns, or acquires the Meta to each stage, the game generally becomes much easier to navigate. The player can and will use the meta to defeat each stage applying this concept i.e; making use of the stronger or most efficient characters where necessary.

Simpler analysis of the metagame in crypto:

To align the anecdotal reference given above to the discourse - Crypto, We have to dissect Cobie’s consideration of the identification of the meta as the metagame. Foremostly, it is imperative to note that the crypto industry is still in its nascent era and so many ideas are being born either to catalyze the industry or as a cash-grab!

From this statement, it is clear that identifying the meta has both its perks and its peril. This is linear to the phenomenon that riding the waves of the crypto market is dependent on the captain’s capability to differentiate technically sound projects” from mere hullabaloo.

Let’s break down Cobie’s example of ‘SoLunAvax” - This word or term is a shortener for Solana, Luna, and Avax tokens - all three being alternative smart contracts to ethereum.

Here, the reference point is Ethereum’s flaws as a layer 1 blockchain which leads to solutions springing up. Naturally, the crypto industry operates just like any other industry still trying to scale - just as new languages are written for developers to find programming much easier, the crypto-industry also operates on the “Lego model” of building on existing technology either through forking the structure for modifications or building on the concept. And so, It was only a matter of time for alternative smart contracts to the surface, some of them referring to themselves as “Ethereum Killers” ( I still do not know the rationale behind this tag). However, what is essential, is identifying the meta at play here - as these alternative smart contracts launched, they did so with a token. Therefore, investing, trading or hodling either of Sol, Luna, or Avax proved to be the right move for those who understood the Meta, took action, and were “early”.

With the success of each of these chains, a new “Meta” evolved. The next play was obviously to ride the metagame of products built using these smart contracts following the success of those that built on ethereum or simply bet on other alternatives.

Therefore, my classification of what I term the meta-action is divided into three(3);

The Negative SuperMeta: The direction of the market arising from the inefficiency or Achilles heel of a project, product, and concept.

The Positive SuperMeta: The direction of the market arising from the success of a project, product, and concept.

The Sub-Meta: The direction of the market following the success of the positive or negative super meta.

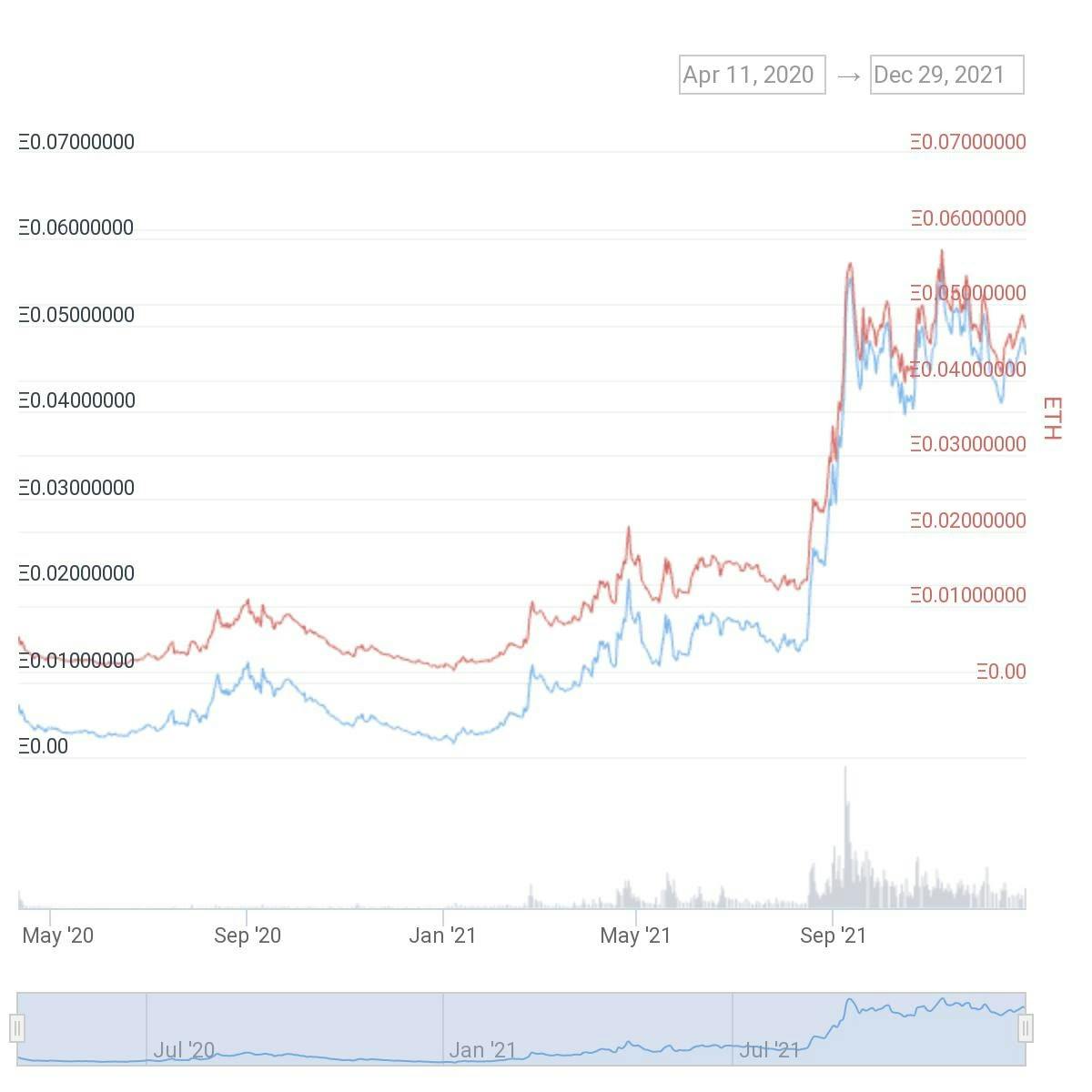

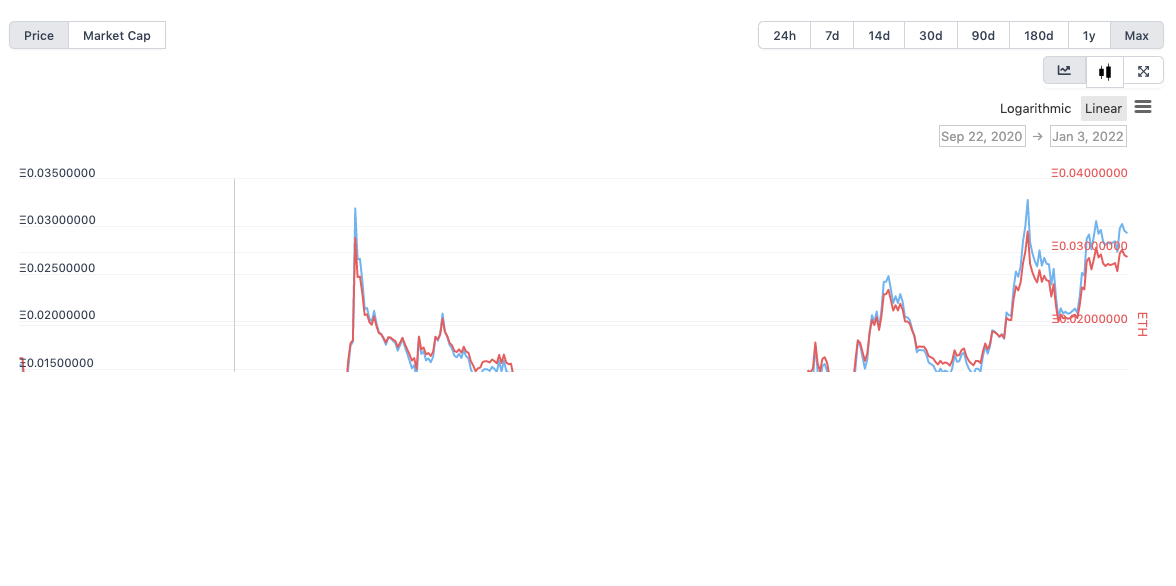

Sol/Eth and Avax/Eth price action Apr 11th, 2020- 29th Dec 2021 and Sept 3rd, 2020 - Jan 3rd, 2022.

Sol/Eth and Avax/Eth price action Apr 11th, 2020- 29th Dec 2021 and Sept 3rd, 2020 - Jan 3rd, 2022.

The Dynamism of Metas and the Economics of attention:

It is also important that metas are dynamic. This nature is essential for how fluid the crypto markets can be. Cobie described an aspect of the dynamism of metas as “fleeting & unsustainable” as it relates to the NFT market and the likes of BAYC, Cryptopunks, and other popular bluechip NFTs. To Cobie, the success of these aforementioned NFT projects led to a wave of NFT euphoria with both good actors and bad actors attempting to create; “The next cryptopunk” or “The next BoredApe”. A bunch of these projects failed or “Rekt” those who bought into them. As someone who got “Rekt” chasing blue chips, to experience Valhalla, I can understand the driving force behind my motive, behavior, and action - what Cobie rightly describes as FOMO.

And so, a concept that I feel is at play here is the economics of attention which is very evident in the NFT market. The attention span on projects in the crypto space is short. Today it’s shiny, tomorrow it’s stale and people have moved on. Due to this, it becomes difficult to identify and use the meta. Also, a better look into how dynamic the NFT metagame is, shows that early identifiers of the Meta or in Cobie’s words “ those aware of the meta '' were not the only benefactors or “Big winners” of the trend as more actors continue to benefit. An example is in MAYC which is borne off the idea of being the next BAYC reaching a significant 10ETH floor as at the time when this article was written. Thus, other factors apart from just merely being aware of the meta or the incentive structure are equally responsible for the success of benefactors of this NFT metagame. In my opinion, community resilience, the economics of attention often engineered by influencers should not be overlooked when analyzing the successes of certain metas.

On the other hand, attention is a valuable asset in the crypto space. The probability for a project to succeed is high when there is long-lasting attention on such a project or the product has successfully captured the attention of users within the space. What it is, however, is the accrual of long-lasting positive attention as opposed to a short euphoria. Naturally, Metas are attention grabbers, and psychologically, the consequent market reaction for when there is increased attention on a product, project, concept, or “The Meta '' is mostly negative. This leaves us with the question; how do we identify metas such that they are not yet affected by the economics of attention?

Identifying the Meta - Are reward tokens the new meta?

Cobie’s piece on the metagame functioned as an eye-opener to the idea of a metagame at play at every given point in time in the crypto-verse. Whether this meta is borne out of the success or failure of an existing project or it is a sub-metagame, identifying and putting the meta to use is what is important in the crypto metagame.

From an observatory pov, the best way to identify a metagame is by doing your research and having a holistic understanding of the flow of the industry. What’s next, where’s it going, what was pretty great, and what seeks to improve on what’s pretty great. Doing your research (DYOR) is as old as crypto itself and will never go out of style. While it’s okay to follow remarkable CT thought leaders or influencers, the majority of them are profit-seeking individuals like the best of us, and will only “shill” to dump on you. However, this is not a word on marble or it isn’t cast in stone. A potential metagame play can be revealed from honest conversations between notable accounts across CT. The bottom line is being invested in understanding the flow will do you some good. To profit from a metagame you have to be early and if it’s viral, you’re at best, exit liquidity to those who saw the meta before you or those who understood the metagame at play better than you did.

Are “reward” tokens the new Metagame? My answer to this is a big NO. Although the new trend of randomly airdropped tokens (such as $SOS) being distributed as a reward to individuals for their participation in a specific or non-specific crypto activity seems cool and more frequent nowadays, it cannot “per se” be considered as a metagame. Surely, it’s a great marketing technique - it temporarily makes everyone happy and the project team behind the drop can easily get the attention of the recipients especially if it’s worth a fortune. However, it doesn’t exclusively feel like a metagame majorly because it lacks the “mystery factor” and is already much exposed.

Finding the metagame is not waiting for some ritual crypto Christmas-like activity to occur continuously but it is putting effort to understand the things you as an investor or player might find inconsequential.

Finally, this is not a pro-tip. However, you will most likely lose a ton trying to find a metagame yourself or betting on a play because you are convinced that it’s going to be the next big wave in the crypto exodus. If you are a “noob” or “newbie”, try to pay attention more than just jumping in to avoid making grave mistakes.